Mar 26, 2020 / News

We’re Here and We’re Ready to Help

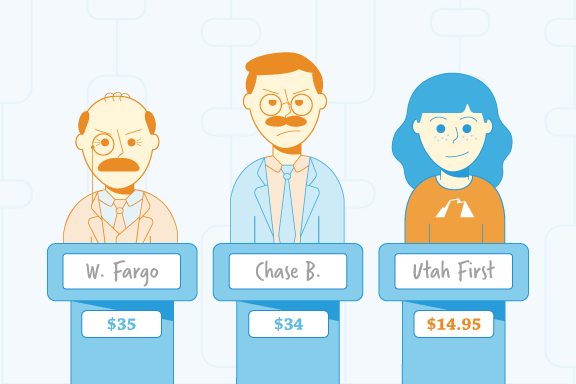

Jan 27, 2020 / Money Tips

Is Your Big Bank Playing Games with Your Money?

Dec 19, 2019 / Credit

Why Orange Platinum is the New Color of the Season

Nov 06, 2019 / Money Tips

4 Money Mistakes to Avoid this Holiday Season

Oct 30, 2019 / Money Tips

Know Your Spending Triggers and How to Avoid Them

Oct 23, 2019 / Local Utah

3 Reasons Utah is a Great Place to Grow Your Money

Oct 09, 2019 / Money Tips

Try a Financial Fast to Save More Money

Sep 18, 2019 / Money Tips

Why Your Financial Plan Should Include a Money Market Account

Sep 11, 2019 / Local Utah

Top 5 Reasons to Choose a Community Credit Union

Jul 01, 2019 / Money Tips

Why Less is Really More with Your Credit Card