Mar 31, 2023 / Money Tips

Spring Cleaning for Your Finances

Mar 24, 2023 / Money Tips

10 Quick Tips to Save for Retirement

Mar 16, 2023 / News

Peace of Mind for Your Money: Understanding the Silicon Valley Bank Failure

Mar 03, 2023 / Money Market

How Does a Money Market Account Work?

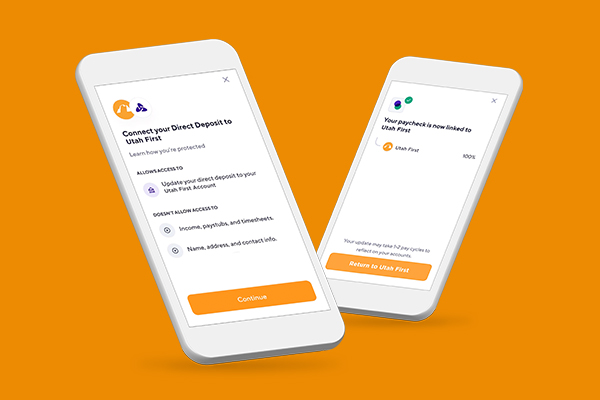

Feb 24, 2023 / News

A More Direct Way to Do Direct Deposit

Feb 17, 2023 / Credit

How Revolving Credit Can Keep Your Financial Life In Balance

Feb 10, 2023 / Money Tips

Feb 03, 2023 / Home Equity

3 Ways You Can Use a HELOC This Spring

Jan 28, 2023 / Money Tips

Four Financial Solutions for Tax Time

Jan 20, 2023 / Money Tips

What Are Your Financial Goals for 2023?